Key takeaways:

- Infor has a diverse set of applications that span many industries and they believe opportunities for “adjacent innovation” are a company strength

- Infor continues to make significant investments in their application layer and bringing their solutions to the cloud, with strong early results

- The company is working to shore up a weakness in services with both organic investments and key partnerships with systems integrators like HCL

Over 7,000 attendees converged on the Javit’s Center in New York City to attend Inforum 2016, the Infor user event of the year, held from July 10 to 13. Infor is a major provider of enterprise software constructed mainly through acquisitions and offers dozens of applications. In several instances the company has more than one offering in the same enterprise software segment, such as in enterprise resource planning (ERP). Five years ago, a new management team was brought in to help the company move forward, led by their CEO, Mr. Charles Phillips. He opened the conference highlighting the company’s strategy: leveraging their industry strength and providing “last mile” features and value-added content; a focus on design, design thinking, digital transformation, and user-centered experiences; expanding the applications of science like predictive analytics, machine learning, and optimization;[1] with delivery through the Internet via a global cloud strategy, relying on open source technology and XML integration. While Infor may have a very diverse set of applications, Mr. Phillips believes their diversity is a company strength and provides a rich source of innovation. Mr. Phillips stated that, because they are in so many industries they create numerous opportunities for “adjacent innovation” by looking at problems and solutions in one industry then bringing that knowledge to others. In fact, Dassault Systèmes and other PLM solution providers have made the same claims, and based on CIMdata’s experience, there is some validity for this strategy.

The goal for Mr. Phillips and his team is to get their applications to the cloud. He provided a high level view of Infor’s CloudSuites, which graphically looks like a hub and spoke system. Infor’s strongest ERP solutions, such as Infor M3, Infor LN, and Infor SyteLine, act as the hubs in this metaphor. These ERP solutions provide the encoded knowledge of working in the targeted industries, and then linking with other Infor solutions like Enterprise Asset Management (EAM), Product Lifecycle Management (PLM), and others, along the spokes. According to Mr. Phillips, the solutions are configured for each industry. The company hires subject matter experts from those industries to develop and support the offerings, which often result from co-innovation with leading customers.

Mr. Stephan Scholl, President of Infor, followed up with more details on the results to date from their work to “completely transform the enterprise landscape.” Mr. Scholl claimed that Infor has invested almost $3B in the application layer in the last several years, which he believed was fairly exceptional in the enterprise software business. (SAP’s investment in HANA and S/4HANA is surely quite large.) To build these new offerings and optimize the user experience,[2] Infor relied on their in-house design agency, Hook and Loop (H&L), which they claimed to be the largest design agency in a software company in the world. The stated results are indeed quite impressive. According to Mr. Scholl, three years ago cloud revenues were 3% of Infor’s total. Today they are 50% and Infor trails only Netflix and a few others as the biggest clients of Amazon Web Services (AWS) cloud infrastructure. Their 7,000+ unique cloud customers have over 62 million users in 103 countries served by 12 AWS regions. Infor also claimed over 100,000 upgrades to cloud solutions in this adoption wave. Recent studies from companies like Gartner, IDC, and Forrester suggest that 16 to 20% of the global enterprise software market is on the cloud,[3] so clearly Infor is doing its part to raise the average.

Based on the presentations and announcements at Inforum, the company is far from done. The company announced Infor IoT, which will connect with Internet of Things-enabled Infor CloudSuites and leverage their “Commerce Cloud” based on their 2015 acquisition of GT Nexus[4] as well as Infor’s Ming.le collaboration offering. When talking about IoT, Mr. Duncan Angove, another Infor President, stated “every new sensor is a business opportunity and a potential point of disruption.” His session focused on Infor’s efforts to commoditize IoT for the enterprise using their believed differentiation in this space. They do have analytics capabilities and are investing, as described above. The company also has strengths and deep knowledge in many of their target industries. Any company looking to succeed in the Industrial Internet market needs to have industry-specific knowledge about device connectivity, transport protocols, security, and compliance, and Infor claims to bring this to the table. CIMdata believes that IoT is an important area for enterprise software companies in the ERP and EAM markets, since these applications help companies build and manage assets that are getting smarter and more connected, and Infor’s move into IoT makes perfect sense.

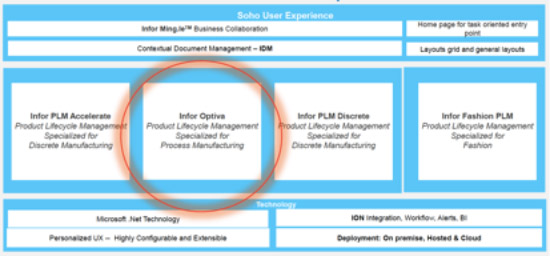

Figure 1—Infor PLM Suite Footprint

The event also highlighted Infor Optiva, Infor’s PLM solution for formulation. Figure 1 illustrates how Infor Optiva fits into Infor’s overall PLM offering. According to Infor, their Optiva revenues grew 44% in FY2014, another 48% in FY2015, and 50% in FY2016. A lot of this success came from cross selling to their Infor M3 customers. Today they are running the on-premise version of Infor Optiva hosted on AWS, but the plan is to offer a multi-tenant version next year. CIMdata also had the pleasure of in-depth conversations with two leading Infor customers: Dr. Pepper/Snapple and Nu Skin, a Provo, Utah based maker of personal care and nutraceutical products. Both companies have good-sized implementations of 150-200 seats and are using Infor Optiva with SAP.

Many customers at the event mostly lauded Infor for their product development efforts. But several talked about the need for improved services to support their deployments. Mr. Darren Saumur, Global Head of Infor Services, acknowledged that Infor had to be good at software AND services, and that they had made major changes to their services business in response. He described how the company needed to evolve its services capabilities as they moved from selling products, to suites of products, and now to the cloud. His Infor Services team recently brought together several groups, including their previous consulting business, customer support, and their cloud operations business. The change is new but is already paying dividends, according to Mr. Saumur. He claims it gives the team a different perspective. For example, non-billable consultants work to close support tickets when they are not otherwise busy, which Mr. Saumur believes makes them a better consultant in the end. The group now has 3,500+ consultants, 1,200+ support professionals, and operates three Centers of Excellence (CoEs) to support their global clients. This is an important move, and one that is vital to the success of their current and future customers. Infor is bolstering their global services ability with partners like HCL, a Diamond sponsor of the event. Since announcing their partnership in 2015, HCL,[5] the Indian-based systems integrator, built a global Infor practice 650 members strong. Their goal is to “Lift and Shift” customers to the cloud at their own pace. Adding global resources will extend Infor’s reach, which is necessary given the geographic spread of their evolving cloud-based clientele.

In conclusion, Inforum 2016 was a high-energy event that showed just how far Infor has come in the last five years. While PLM was not the focus of the event, it is a key part of their industry-focused strategy and a key application in their CloudSuite offerings. Infor is getting significant revenues from the cloud, even though the applications have not fully migrated to true cloud-based versions. This is a good sign for cloud adoption in manufacturing, and consistent with CIMdata’s belief that smaller manufacturers are a good fit for adoption of cloud-based infrastructure in the near term. Infor’s success to date in moving their legacy customers to more modern offerings bodes well for the company going forward. With many CloudSuite offerings evolving to multi-tenant in 2017, the next year will indeed be interesting. We look forward to an update at Inforum 2017.

http://www.forbes.com/sites/louiscolumbus/2014/12/20/idc-predicts-saas-enterprise-applications-will-be-a-50-8b-market-by-2018/