Key Takeaways

- China's PLM market continues to rapidly expand, exceeding US$3.62 billion in 2022, up 7.5% from 2021. While the global PLM market grew by 10.0% and reached US$66.6 billion in 2022, China's PLM market share decreased slightly, from 5.6% in 2021 to 5.4% in 2022.

- World-class manufacturers require accurate, traceable product information to meet innovation, as well as efficiency requirements and a Product Innovation Platform is a best-in-class approach to enabling end-to-end sustainable PLM that meets those requirements.

- JWI’s PLM platform, developed in China for China, is based on a modern microservice architecture and runs on-premises, in the cloud, or a hybrid of both, while supporting real-time app-based solutions across extended enterprises.

- JWI is providing a PLM solution that scales from SMBs through multi-national corporations with a complete international technology stack that leverages modern software development technologies and business practices across the lifecycle for discrete manufacturers.

Introduction

The roots of PLM can be traced back to product development and manufacturing support. Efficient bills of material generation and management, process planning, and data accuracy were early goals. Modern objectives of discrete manufacturers focus on improving the front end of the lifecycle with approaches like Model-Based Systems Engineering (MBSE), Simulation & Analysis, and capturing profitable after-sales revenue by managing the as-operated and as-maintained lifecycle states. Market and mindshare leaders in PLM from the United States and Europe are investing heavily in ensuring their product innovation platforms meet the extended lifecycle requirements of their customers. Evolution in global trade relationships and the risk of decoupling (i.e., the reduction of trade between the West and China) has opened opportunities for local solution providers to provide software with a better customer and market fit for China-based manufacturers.[1]

While capable and proven, many of today’s leading PLM solution providers have complex software systems built using architectures designed for on-premises deployments, often including rather complex technical debt based on legacy code. Forward-thinking solution providers are migrating their platforms to be more service-oriented and leveraging microservices to take advantage of the cost and performance potential of cloud-native services. At an increasing rate, Chinese companies want locally developed, lower-cost solutions to support their digital transformation requirements and local solution providers, including JWI are beginning to deliver.

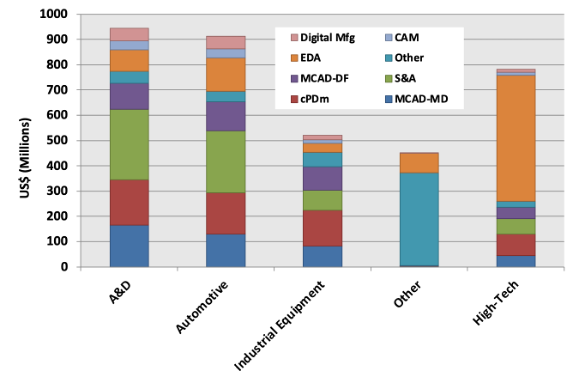

At the same time, some solution providers are building a new generation of cloud-native solutions on raw cloud platforms such as Microsoft Azure, AWS, Alibaba, and Tencent or application-focused clouds such as Force.com or Forge.com. Most of the new generation of cloud-based PLM platforms focus on the engineering part of the product lifecycle. They support parts, EBOM, engineering change management, and ERP integration, a high-value, very visible portion of the lifecycle. Within China, A&D, Automotive, Industrial Equipment, and High-Tech are the largest customers for PLM-enabling solutions. Figure 1 shows the revenue for the various technology areas by industry in 2022.

Figure 1—Market Segment Analysis of China’s PLM Industry

(CIMdata Market Research Estimates)

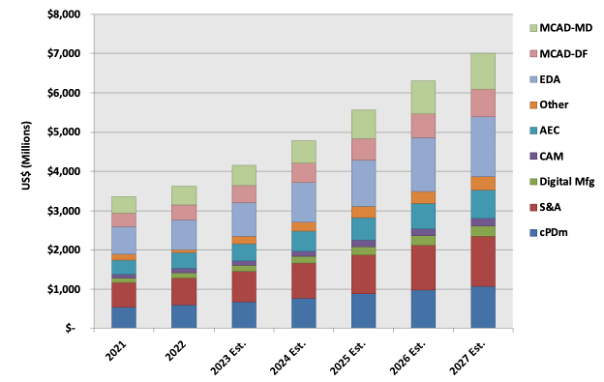

As Chinese companies evolve from pure manufacturing and make-to-print operations, they are taking on higher value activities, including change management and product design, and in a few cases, marketing their brands globally. ERP was the only solution required for contract manufacturing, but CIMdata now sees a rapidly growing market for PLM in China to support the move up the value chain. Figure 2 shows the expected growth of mainstream PLM market segments through 2027.

Figure 2—Development of China’s Mainstream PLM Market Segments and Forecasts from 2021 to 2027

(CIMdata Market Research Estimates)

China’s PLM market exceeded US$3.62 billion in 2022, up 7.5% from 2021. The global PLM market grew by 10.0% and reached US$66.6 billion in 2022, while China’s PLM market share decreased from 5.6% in 2021 to 5.4% in 2022.

CIMdata’s research tracks, among other things, emerging PLM market participants, including service and software providers. We have been following JWI for several years, and they recently gave CIMdata a briefing on their latest technology platform and business developments.

Introducing JWI

JWI was founded in 2007 and is based in Shenzhen, China’s innovation hub. JWI has a long history of implementing PLM solutions and has been one of the largest implementers of PLM solutions in China. They developed their platform to overcome issues manufacturing companies face every day while implementing other solution providers’ PLM solutions. Mr. Per Johnsson, founder of JWI, spent many years working for PLM mindshare leaders in China and has used his knowledge of PLM and the Chinese market to create a new solution. The JWI cloud-native innovation platform was designed to meet the needs of Chinese companies and architected to meet the requirements of multinational innovators. JWI has had significant success recently and closed deals with over 50 new customers in 2023, more than doubling their sales revenue.

The JWI PLM Platform

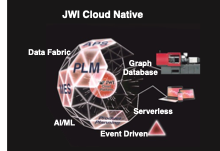

A Product Innovation Platform[2] is a best-in-class approach to enabling end-to-end sustainable PLM. Predicting business needs more than a few years out is difficult, so the best approach is to have a flexible solution that can adapt to unforeseen needs. JWI has evolved its PLM solution platform to be cloud-native and support state-of-the-art DevOps processes. Figure 3 shows some of the modern technology built into their core platform such as graph database support, serverless operations, data fabric support (i.e., an architecture that connects data and knowledge at scale in a distributed and decentralized manner[3]), and Artificial Intelligence (and Machine Learning (AI/ML). This technology helps address performance and scalability issues often common with legacy on-premises solutions.

DevOps simplifies customization and upgrades according to JWI; microservices can be updated independently and as needed, and while cloud-native, the solution is cloud agnostic and can also be run on-premises. AI/ML are built in rather than pasted on. JWI claims their AI capability connects a product's digital thread in real-time through inferred relationships from domain-specific data models rather than explicit data modeling, something CIMdata hasn’t seen elsewhere.

Figure 3—JWI Cloud Architecture

(Courtesy of JWI)

JWI is incredibly proud of the real-time event processing built into the core of its platform. This was done to facilitate Industrial Internet of Things (IIoT). The benefit is that it enables efficient closed-loop processes from production or in-service operation back to the innovation processes. Incorporating IIoT as a native service on the platform is a major strength.

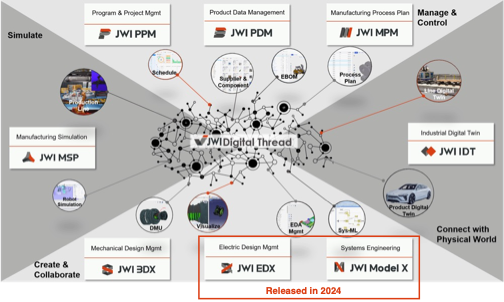

Figure 4—JWI Applications

(Courtesy of JWI)

Since CIMdata previously talked to JWI in 2019, they have significantly expanded their available applications. From an application perspective, JWI uses its microservice architecture to support engineering, manufacturing, and products in the field. The digital thread, as shown in Figure 4, is an important requirement for companies, and the connectivity it enables reduces time-to-market, improves quality and lowers cost by improving data and process connectivity. To provide flexibility for creating the dynamic digital thread, each JWI application has its own data model. The JWI 3DX mechanical design management application uses a model-based approach for integrating CAD solutions, easing traditional complexity. Other enterprise solutions and custom applications use the same approach for integration. They have added additional capabilities, such as MBSE support with integration to ALM and MBSE tools, as well as digital twin support to close the product lifecycle loop.

While JWI is more and more focused on SaaS and hybrid cloud deployments for the SMB market, they will continue to support large multinational enterprises and believe the flexibility offered by their architecture and ability to quickly develop custom functionality will deliver what their customers need independent of company size or complexity. CIMdata believes that architectural flexibility is critical to successful PLM solutions and JWI’s 2023 business success supports this premise.

Mr. Johnsson stated, “We can support any industry’s requirements and both small and very large complex customers, proven by the 50 deployments in 2023 across seven major industries and very diverse customer size and complexity. All thanks to the Cloud-native architecture and distributed application strategy.” He further stated, “Our solution can co-exist with legacy PLM during long and complex transitions thanks to our microservices approach, domain-based data structure, and digital thread. This allows us to slowly and safely replace legacy PLM in complex transitions and upgrade and improve the areas of PLM that add the most value to our customers while co-existing with the legacy technology.” Again, CIMdata is impressed with JWI’s progress but are still looking forward to seeing the impact of AI/ML on their solutions.

Conclusion

Global trade, politics, and competition are driving China to develop more sophisticated products and infrastructure, including native software solutions. PLM is becoming one of those needed solutions. To compete globally, and even within China, companies need to step up their game, as competing primarily based on low-cost labor is not a viable long-term strategy.

In 2017, CIMdata forecasted the PLM market in China in 2023 to be about US$ 3 billion, exceeding US$ 3.6 billion; by 2027, we forecast it to be US$ 7.0 billion. This market growth shows the need for PLM and the opportunity and requirement for local solution providers to exist. JWI’s PLM platform has the proven capabilities needed to support local Chinese requirements and is architected to provide the support multinational manufacturers require. CIMdata is impressed by the JWI platform’s technology and focus on customer needs via its application strategy. Given the change in market dynamics and JWI’s strategy, we look forward to tracking its financial growth and how the Chinese market transitions to locally developed solutions.

For Chinese and Asian companies looking for a PLM solution, JWI should be on their shortlist.