Key takeaways:

- Rapid changes in technology, such as the evolution of smart, connected products and the Internet of Things, are making product development efforts more complex, reducing companies’ returns on R&D investments.

- Many company’s problems are exacerbated by ongoing changes in the engineering workforce and the introduction of disruptive business models from nimble “digital native” competitors.

- As a result, many companies find their engineering teams are spending much less time on innovating new products and technologies and they struggle to keep up with the technical and developmental clock speed required to compete and win in this new competitive environment.

- Accenture’s Engineering & Product Operations services focus on providing strategic guidance and action to help companies optimize their engineering operating models and create the imperative for organizations to transform themselves—increasing scale, agility, efficiency and enabling new sources of value.

The days when firms could be content simply competing in their local markets are long over. No matter the industry, companies find themselves competing globally. Where once they could sell the same product in many localized markets, competitive pressures demand that offerings be tailored to the specific needs of individual countries or regions. At the same time products themselves are evolving, becoming first smart and increasingly connected. The great promise of the Internet of Things (IoT) is creating new opportunities and, indeed, new business models that shake the foundations of long-standing product markets. Where they once could reliably expect returns on their investments in research and development (R&D), now companies often struggle just to essentially stand in place, spending much of their budget on maintaining their current products, not innovation.

Meeting today’s global business requirements challenges their current engineering operating models and product lifecycle processes. Their processes must become more agile and support expanding the scale and speed of innovation. Products that used to be refreshed annually now may be updated weekly (for instance, through software updates). Major components may come from an ever-changing group of value chain partners.

These new smart, connected products generate vast amounts of data that must be leveraged in new ways. Operating data can be mined to understand product usage, changing decision-making processes from hunches based on past experience to more transparent, fact-based decisions using predictive analytics. Analyzed data must also include customer insights from social media, crowdsourcing, and other sources.

Many firms have been slow to react to these changes. Inertia is a common problem. People do not know where or how to start so they do nothing. Fear of change also plays into this dynamic. Some worry that any change will negatively affect their ongoing product development initiatives. In addition, companies are often siloed, with engineering teams and development processes intentionally kept separate, making it difficult to move to a more synthetic, collaborative approach.

Competing successfully requires assimilating new technologies. Many discrete manufacturers are just now feeling comfortable developing smart products, but making them connected and leveraging the resulting data is beyond their capabilities. They need new processes that are more streamlined and new organizational structures to meet these new requirements. For example, many successful companies choose to organize centers of excellence and shared services to support centralized resources to provide consistent responses across their organizations.

At the same time, companies can find their traditional markets slipping away, taken by “as-a-service” competitors. The more innovative among them may choose to compete that way themselves. To make this change, their products must have improved reliability and performance to meet the demanding requirements of service level agreements (SLAs), a big change over traditional product sales and service.

Unfortunately, the PLM strategies and IT environments in many companies are not ready for this new reality. Many companies are built through acquisition and have a wide range of PLM-related software, with siloed functions and data. Despite the “Tower of Babel” that may result, many companies still loathe to make changes because they fear it will “break the magic” of their product development process. Based on CIMdata’s experience, the “magic” is actually people making superhuman efforts to overcome process and technology deficits. Even if they want to change, those changes have to be introduced without disrupting their core businesses and existing clientele. Their current environments also do not operate the way the workforce of the future (or even present) want to work. They are used to social tools enabling more fluid collaboration. They expect to work wherever, whenever, with mobile devices supporting their remote use cases.

Accenture, one of the world’s leading strategic consulting firms, has a Product Engineering & Lifecycle Services (PE&LS) practice that offers Engineering & Product Operations services to help their clients meet these challenges. The PE&LS practice includes over 10,000 product lifecycle professionals spanning Design & Engineering, Manufacturing, Product Service, and IoT & Connected Products. Engineering & Product Operations resides in Accenture’s Design & Engineering team, and combines Accenture’s expertise in engineering and R&D with their Integrated Operating Model practice.

Accenture works with clients to improve the adaptability of their engineering operations, and on broader operating model evolution. Before companies can “run” with new business models, they often have to learn to walk. Their product development, manufacturing, and back office processes have to mature and evolve to support their desired business model change. That’s where Accenture comes in.

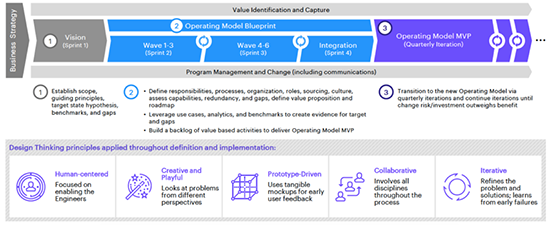

Using an agile development model, Accenture plans and executes agile sprints to develop blueprints for new operating models. This process is depicted in Figure 1. In agile practice, the goal is to rapidly develop a minimum viable product (MVP) focused around needed changes in existing models. These MVPs are not the final answer but a starting point that can be evolved using in-depth feedback from users. This is in stark contrast to existing approaches to organizational change, which tend toward long planning cycles developing monolithic changes. These repeated sprint and feedback cycles can help keep users engaged, a key success factor in making such changes.

Figure 1—Accenture’s Human-Centered Development Process

Accenture focuses their support for change across five operating model attributes:

- Processes & Governance

- Data & Performance Measurement

- Engineering Services & Centers of Excellence

- Staffing & Organization

- Tools & Infrastructure

Accenture believes that companies should not spend six months planning how the organization will be changed just to find out it is wrong. Accenture’s process includes design-led thinking, an approach to achieve more human-centric results. Encouraging engineers to think this way, and having them work together in design thinking workshops, helps get them out of their comfort zone. CIMdata has seen other companies have great success using design thinking, and applying it to engineering and PLM makes sense.

An organization’s PLM strategies, processes, and tools must adapt to this new reality. Accenture’s Engineering & Product Operations services can help organizations work to achieve real transformation in engineering operating model excellence. CIMdata reviewed a number of customer cases with Accenture and the results to date are indeed impressive. Clients report improvements such as reduced operational costs, improved speed to innovation, increased process efficiency and increased agility of their R&D initiatives.

Conclusion

Markets and products are changing faster than ever before, and companies need to evolve across a range of dimensions to keep up. Accenture’s Engineering & Product Operations services are designed to help their clients meet these challenges. Their embracing of agile development helps deliver MVPs with sufficient features to satisfy early adopters. Only after getting feedback from these early users are the final, complete set of features designed and developed. This can help companies get over a big hurdle in implementing previous generations of PLM-enabling solutions, i.e., taking a long time to get to value. CIMdata believes this is a good approach, having seen others succeed using agile in PLM and with design thinking in a number of problem domains. The successes to date highlight Accenture’s focus on metrics and ROI with clients. This is important because, in CIMdata’s experience, many organizations develop quantitative goals to justify investments. Showing hard numbers about success can help companies overcome resistance to change as employees see the benefits of their labors. With many companies facing this range of issues, Accenture’s team should be quite busy.