Key takeaways:

- The long-awaited merger of Geometric and HCL is complete, and the combined entity has the capabilities to support next generation products and evolving business models using a newly created dedicated service line known as GeometricPLM.

- HCL leverages the best of both organizations, the traditional PLM strengths of Geometric, with the IT and product realization expertise of HCL, providing customers and prospects end-to-end services for their product lifecycle needs.

- HCL’s capabilities include commercial software products to support product development such as CAMWorks, DFMPro, and GeometricEDGE, and is further strengthened by major investments made by HCL in Industry 4.0, analytics, and MES.

HCL recently completed its acquisition of Geometric. Geometric has been a very familiar name to PLM oriented people in automotive, aerospace, and other industrial companies. They developed deep experience with multiple tools, technologies, and processes that support the creation of product data. Geometric also developed a strong system integration (SI) practice focused on engineering IT. A measure of Geometric’s success is their well-known clients, and the decade long longevity of many of their engagements.

HCL, a much larger company than Geometric, focuses on product development and realization. They provide a broad range of technology and services solutions including infrastructure management, application development, business process optimization (BPO), engineering, and R&D services. Their 2016 revenue was about US$7 billion. Their Engineering and R&D Services (ERS) division, which produces over 1.5 billion dollars in revenue, supports multiple industry segments including A&D, automotive, industrial equipment, high-tech, and health care. Technical domains supported include mechanical engineering, hardware design (FPGA and VLSI design, prototyping and low volume manufacturing), embedded application software, product engineering and testing, and PLM Services to support engineering and manufacturing. CIMdata views these domains that HCL is focused on as critical to the needs of industry as smart, connected products become more prevalent.

CIMdata sees the combination of HCL and Geometric as synergistic. There was very minimal overlap in their businesses, the skillsets each company provides is complimentary, and the merger should bring benefits to all of HCL’s and Geometric’s customers.

Introducing GeometricPLM

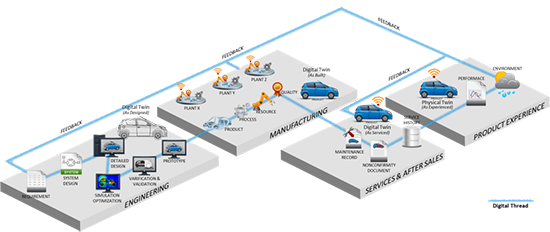

The acquisition of Geometric comes with over two decades of PLM services experience and a track record of successful large PLM implementations. HCL is using Geometric’s capabilities to further strengthen its position in the end-to-end engineering services space. HCL has created a separate service line focused on PLM which cuts across industry verticals. Geometric’s acquisition is a strategic move by HCL to support changing business needs of its customers. Now, with GeometricPLM, HCL is better positioned to support digitalization, digital thread, and digital twin initiatives of global manufacturers, adding PLM to their strong capabilities in MES, MoM, and aftermarket services. As shown in Figure 1, HCL now has the capability to connect traditional silos and align enterprise value elements, i.e., People, Process, Technology, Data, and Things.

Figure 1–GeometricPLM Enabling Digital Enterprises

(Courtesy of HCL)

CIMdata agrees with HCL that successful companies need to establish these connections and enable bidirectional traceability. Product Innovation Platforms are the foundation needed to support this kind of end-to-end connectivity across the extended enterprise and HCL is working to satisfy that need.

CIMdata has previously commented on CAMWorks,[1] DFMPro,[2] and GeometricEDGE,[3] key Geometric products, and felt that the commercial software products and software development organization was a differentiator when compared to their SI competition. In addition, Geometric has strong business and technical relationships with Dassault Systèmes, PTC, Siemens PLM Software and is building a relationship with Aras. All these strengths from Geometric are going to help HCL support their “21st Century PLM” strategy.

HCL has invested heavily in product development over the last four decades within their supported industry segments, and more recently has been investing heavily in Industry 4.0 and the Internet of Things (IoT). Beyond design, HCL provides product engineering services including prototyping and testing. CIMdata believes HCL’s physical product testing is a critical capability to support verification of virtual models used in product engineering, and validation of smart, connected products, especially in regulated industries such as A&D and medical devices. In addition, we hope to see HCL develop solutions that make testing results more useable in the early stages of product development to support a more closed loop process.

End-to-End Lifecycle Support

CIMdata believes that companies need to operate holistically to maximize success and understand how decisions impact the complete lifecycles of their products. HCL’s ERS division has over 26,500 engineers to support their customers. Analytics is another area of investment that HCL has made so they can help companies collect data generated by production facilities and products, and process it to expand business opportunities. We hope to see Geometric’s knowledge of the virtual product combined with HCL’s knowledge of the physical product to create richer end-to-end solutions that improve their clients’ competitiveness.

Customer Benefits

Geometric’s clients benefit from the additional skillset and stability that HCL brings and can leverage HCL’s product realization capabilities. HCL’s customers can now receive one stop shopping for both product realization and their supporting PLM environment.

CIMdata’s leading industrial clients are focused on optimizing the end-to-end lifecycle of their products from requirements, through design, production, and after sales support. Accomplishing this requires a partner that understands the product, the product realization process, and the underlying solutions necessary to support the complete end-to-end process. HCL provides solutions for each of these capabilities.

Conclusion

Industrial companies looking for integrated systems and services, especially those with smart, connected product needs should check out HCL. Solution providers and technology developers within the PLM market may want to consider partnering with HCL. They have the scale, as well as technical breadth and depth to represent PLM-enabling products.

The combination of HCL and Geometric places their revenue among the world’s largest independent PLM service providers. They are focused on where products are going—smart and connected. As a service provider, HCL’s commercial products are a significant differentiator. The Geometric acquisition is good for HCL customers as they have access to a deeper and broader set of PLM support capabilities, and good for Geometric customers who can now receive help with product development and product realization from HCL capabilities. If you are a current HCL client, you should consider HCL for your PLM service needs. Furthermore, CIMdata sees this as good for industry as it is getting another capable solution provider which can support evolving product requirements and business models in today’s rapidly changing environment.

CIMdata is looking forward to seeing how the synergies work out in the market. Based on our discussions with HCL, the two organizations seem to be a good cultural fit so we have high expectations for what they will deliver to the market.

[2] See: https://www.cimdata.com/en/resources/complimentary-reports-research/commentaries/item/3345-design-with-confidence-commentary

[3] For more information, see: https://www.cimdata.com/en/resources/complimentary-reports-research/commentaries/item/6366-geometricedge-enabling-secure-data-exchange-for-global-collaboration-commentary