Technological innovation—creative new approaches to the problems we face—have improved our lives and changed our world. Many of these innovations led to products where we took finite materials from the earth, consumed them, and then discarded them in a linear pattern.

Technological innovation—creative new approaches to the problems we face—have improved our lives and changed our world. Many of these innovations led to products where we took finite materials from the earth, consumed them, and then discarded them in a linear pattern.

Today, leading companies use a strategic business approach that supports the collaborative creation, management, dissemination, and use of product data to manage products throughout their lifecycle and the extended enterprise (customers, design, and supply partners, etc.) known as Product Lifecycle Management (PLM). Just to be clear, this is a business approach, not software.

My involvement with PLM (the strategic approach) and PLM software started over three decades ago. During that time, there have been many changes to the products produced, as well as the technologies, processes, and data used throughout a product’s lifecycle, all of which continue to evolve.

Green and Sustainability Trends

When we look back over the past 30-years, we see how the internet has changed not just the products we produce but has altered how business is done and how we interact with each other. Over the next couple of decades, we will experience a new dramatic transformation—how we interact with our environment.

The future energy ecosystem and all it impacts is undergoing a massive shift away from fossil fuels toward more green, renewable, clean, and sustainable sources to decarbonize economies with a goal of “net-zero” carbon emissions by 2050. Decarbonizing the global economy (green energy) is part of the larger sustainability megatrend, which people (consumers), policy makers, and businesses continue to support as awareness grows. The United Nations (U.N.) Sustainable Development Goals (SDG) is a flagship initiative working with the private sector toward the achievement of 17 areas of development goals by 2030.

The primary driver influencing the increased use of green energy is the negative impact of greenhouse gas emissions (GHG) and its contribution to various forms of climate change, including global warming.

The primary driver influencing the increased use of green energy is the negative impact of greenhouse gas emissions (GHG) and its contribution to various forms of climate change, including global warming.

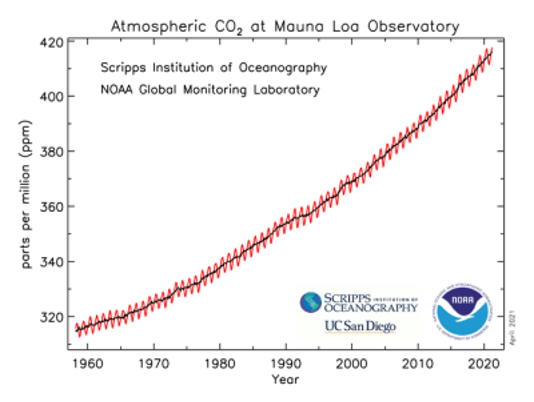

The rise in carbon dioxide (CO2) emissions has been increasing at an alarming rate, as measured in Hawaii by the Scripps Institution of Oceanography. Currently, the earth is about 1.2°C above the average temperature experienced between 1850-1890, with the earth warming and the stratosphere cooling above the GHGs accumulating in our atmosphere.

Even if you downplay human activity as the major cause of climate change, the green energy trend has overwhelming support from people across the globe for reducing GHG emissions.

This increased consumer sentiment has pushed policy makers and businesses to start transforming to green energy and more sustainable practices, with laws being passed to meet reductions in GHG emissions and other sustainability standards. Almost all the world’s 250 largest companies (96%) now report on their sustainability performance. Environmental, Social, and Governance (ESG) is now commonly scrutinized by investors and is no longer a debatable topic in the boardroom. (KPMG, 2020)

Businesses react to their consumers and investors. The C-suite leaders (83%) believe their ESG contributes to more shareholder value. (McKinsey 2020) The speed and flexibility with which many of these companies need to transform and their ability to report on materials used in their products and operations will drive different PLM strategies.

One of the primary catalysts for this transition to decarbonization is the 2015 Paris Agreement, which set the goal of keeping global average temperature increases less than 2°C (3.6˚F) above pre-industrial levels by 2050. To keep global warming to no more than 1.5°C—as called for in the Paris Agreement—emissions need to be reduced 45% by 2030 and reach net-zero by 2050. Current projections are that we will fall far short of the interim goal and not reach the one in 2050, which will only drive people (consumers) to apply more pressure on businesses and regional governments.

Another factor increasing the trend is energy security. Countries with a diversified green energy portfolio reduce their geo-political risk and the economic repercussions caused by an overreliance on imported fossil fuels from other countries. Energy security is now at the forefront for many world leaders due to the war in Ukraine, which has placed countries heavily dependent on Russian oil at greater risk. The shift from fossil fuels toward decarbonization not only impacts energy production and consumption, but also industries such as electrification in the automotive market, shipping cargo (rail, shipping, heavy-duty trucking, and aviation), any type of large facility, from warehouses to manufacturing plants, smart cities, smart buildings, the chemical industry, and many others.

The move to decarbonize GHG is focused primarily on renewable energy sources such as hydro, wind, solar, biomass, green hydrogen biofuels, geothermal, and clean energy sources such as nuclear and lithium-ion batteries (LiBs). This adds up to roughly one-third of GHG emissions. Today, the remainder—almost 35 Gt—comes from fossil fuels. Hence, the market needs to develop and deploy sustainable green energy alternatives.

To give you an idea of the momentum, by 2026, global renewable electricity capacity is forecast to rise more than 60% from 2020 levels. Renewable Energy is predicted to account for 95% of the increase in global power through 2026.

In the short term, we are in an energy crisis, particularly in Europe. Nuclear plants can’t be built fast enough, the sun doesn’t always shine, the wind doesn’t always blow, and storage solutions are not yet as robust as they will be. As a result, we are looking at a heavy-duty gas turbine market that will grow at 7.5% CAGR between 2022 and 2028. However, by 2050, renewable energy is projected to nearly triple and make up 58.4% of the power market. (IEA.org, 2021).

Changing PLM Strategies

From a PLM perspective, this is a shift from the linear “take, make, and waste” manufacturing process to a more circular economy, which will incorporate new disruptive models. (Accenture, 2020) Product offerings increase platform-as-a-service models (PaaS), which will drive a more MBE approach, the use of digital twins, digital thread, IoT platforms, and a highly integrated and flexible supply chain that meets net-zero and ESG regulations.

Products will need to be designed with sustainability in mind from the start, with the ability to adapt to changing requirements. This will necessitate adopting the concept of systems thinking. In the case of a vehicle (a system of systems), we need to consider the people, other vehicles, roads (they are already testing air mobility units), and many other systems, plus recycling and end-of-life “green” directives. As has been the trend, the data associated with the product will continue to expand, and regulations and standards will undoubtedly get tighter. We already have regulations and directives on the Restriction of Hazardous Substances (RoHS), and Waste Electrical and Electronic Equipment (WEEE), and an even more comprehensive directive on the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). The emphasis is clearly expanding in terms of the data on materials and the carbon footprint, which will reach into the supply chain for all components.

Business Value of Designing Green

PLM enables companies to proactively create and manage innovative offerings at less cost in a circular economy. According to Accenture, this is a unique opportunity of upwards of $4.5 trillion by 2030. Accelerating this transition relies on the uptake of innovative new business models and disruptive technological innovation. Alongside prioritization of new business models, which now account for roughly 30% of M&A, adopting new digital, physical, and biological technologies can drive new opportunities for organizations to deliver on profit, people, and the planet. (Weforum.org, 2021).

Predictions on the cost of transitioning to renewable energy have consistently been overestimated. According to a Lawrence Berkley National Laboratory survey, wind experts anticipate cost reductions of 17%-35% by 2035 and 37%-49% by 2050, driven by bigger and more efficient turbines, lower capital, and lower operating costs. (CleanPower.org, 2021) From the materials used to digital twins, this all involves PLM.

In addition to solar and wind, private investors and governments are investing in green hydrogen, advanced batteries, long-term storage, smarter integration of renewable energies with the grid, development of new transmission infrastructure, and many other initiatives, including nuclear fusion. All of which will require increased digitalization and use of PLM.

EoL management strategies offer one of the biggest opportunities to drive down costs and recycle material. Despite supply chain issues, the long-term prospects are strong as recycling of E.V. battery materials could supply 39-57% of the lithium, cobalt, and nickel demand by 2040. (Goldman Sachs, 2022)

We will explore many aspects of the Green Energy trend in the coming months. Those of us in PLM have a unique opportunity to embrace the transformation to green energy and a sustainable circular economy that will benefit our businesses, our customers, and the future of our planet, which, in turn, will benefit us for generations to come.

I look forward to hearing your thoughts.

Mark