Over a good part of the last decade there has been discussion about computer-aided design (CAD) tools becoming a commodity. In some respects, you could make that argument as the lines between high end tools, like CATIA, Creo, and NX and “mid-range” tools like Inventor, Solid Edge, and SolidWorks, have become blurred. (Before anyone gets excited, these tools were listed in alphabetical order, and only represent part of these large markets. In our annual PLM Market Analysis Reports we refer to these segments as MCAD-MD, for multi-discipline, to reflect the broad portfolio of configurable options in the high end tools, and MCAD-DF, for design-focused.)

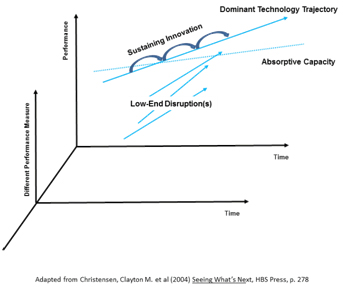

In looking at the PLM market, I have often applied the work of Clayton Christensen of Harvard (built on the shoulders of some researchers who heavily influenced me in past professional lives) to try to understand some of the dynamics. In any given product category, there is a dominant technology “trajectory” along which products in that category evolve. At some point, new features continue to be added which are used by fewer and fewer users.

All of us understand this: just how much of Microsoft Word do YOU use on a regular basis? When those technologies add features used by few people, they can be said to cross the “absorptive capacity” line on the chart. In his outstanding case studies in different industries, Christensen describes how various technological, business, and economic drivers result in the introduction of disruptive technologies that can eventually threaten the dominant paradigm.

Yes, this is all very interesting, you might be saying, but what is the point? CIMdata has recently been doing some competitive assessment work on some of the world’s leading collaborative Product Definition management (cPDm) solutions. After considering hundreds of criteria detailed from our World-Class PLM Business Model, the difference between most of these solutions is not that broad. There are differences, of course, but they are usually in some narrow areas. This is a qualitative argument that it is indeed cPDm that has become commoditized. I have believed this for some time, but this result caused me to think about why. My initial thought: cPDm is more about business process, which is much more common than people in companies like to admit, than about the technology used to support it. In the case of cPDm, the underlying technology is basically the same. All of the major cPDm offerings are built on powerful database systems, which were exposed to the user for far too long in the user interface (UI), one reason for industry-wide usability issues that are just now being addressed. I’d like to hear others opinions on what has driven this commoditization.

If the solutions are not that far apart in the end, are the major cPDm solution providers investing in the right things? We would say they are, as product development itself is evolving and providers need to deepen their cPDm offerings and broaden their portfolios to cover more areas. Looking at most of the companies, you can see they are doing just that. For example, PTC has made moves in quality, costing, service lifecycle management, compliance, and application lifecycle management (ALM). Siemens PLM Software just bought Perfect Costing, which provides focus on product cost analysis, and LMS, which helps them in simulation and analysis (S&A) and systems engineering, an area becoming increasingly important as embedded software adds more value to products across many industries. Dassault Systèmes announced its intent to acquire Accelrys, a leader in analysis and cPDm for lab-based innovation. All of the major players have completed one or more acquisitions in the last few years.

We know that this broadening of the portfolio has meant that very few customers actually use most or all of the offerings from their chosen PLM solution provider. But during some recent meetings, another open question came up: are companies in general below or above the absorptive capacity in their use of their cPDm solutions? Anecdotal data suggests that this is below that line. In most of our industrial clients they are just scratching the surface of what they COULD be doing in PLM. Many are doing “enterprise PLM” processes and workflows, and NOT doing engineering work-in-process with their solutions. (It is interesting that Autodesk splits these two sets of functionality in their PLM 360 and Vault offerings, but that is a topic for another day.) Is this your experience?

If this is the case, then there is a still a lot of work for the cPDm solution providers to do to make those capabilities more powerful AND easier to implement, adopt, and use. As importantly, there is also a lot of work for the Systems Integrators (SIs) and Value-Added Resellers to do to make sure this level of adoption does occur. Follow Stan on Twitter at @smprezbo.

Subscribe to our RSS feed to have future blog postings delivered to your feed reader.