Key takeaways:

- Addressing today’s and tomorrow’s security threats demands a new solution, Oracle’s Second Generation Cloud, offering “Impenetrable Barriers + Autonomous Robots.”

- The Oracle Digital Supply Chain Platform combines Oracle’s traditional enterprise applications with leading edge capabilities like analytics, blockchain, and the IoT.

- Oracle PLM Cloud continues to expand its capabilities and installed base, including more explicit coverage of and support for fielded products using Oracle’s capabilities in IoT, analytics, and machine learning.

CIMdata had the pleasure of attending Oracle OpenWorld, held October 22-25, 2018 in San Francisco, CA. This sprawling event included over 60,000 customers and partners that traveled from 175 countries to participate in this year’s conference. Oracle also claimed that 19 million would attend the event virtually. Even their Analyst Day event on October 22 was large and included over 190 analysts covering every aspect of Oracle’s broad-based portfolio.

The consistent message across keynotes from Mr. Larry Ellison, Oracle’s Founder and Chairman of the Board and Chief Technology Officer, and Mr. Mark Hurd, Oracle Chief Executive Officer, was security. In past years, Mr. Ellison quipped about “chips to fingertips” security. At this year’s event, things got a lot more concrete. In his two keynotes, Mr. Hurd put security in a global geopolitical context. His first keynote was essentially a virtual fireside chat with Mr. Ian Bremer, a well-known American political scientist. Sitting at a talk show host-style desk, Mr. Hurd asked Mr. Bremer for a quick big picture. Mr. Bremer stated that while we are in a world where the U.S. and global economy were doing well the geopolitics do not feel good. In most of the world’s democracies large numbers of people do not think the system works for them. Some of the angst is a reaction to immigration, claimed Mr. Bremer, and demographics plays a role as well. The U.S. and Europe are more divided at a time when China has their strongest leader since Mao. China may pass the U.S. as the world’s largest economy in the next decade, but it is the way they do it that differentiates them, stated Mr. Bremer. When U.S. companies engage with China or other countries, they are mostly going it alone. In contrast, when the Chinese engage with another country it is the Chinese government that is facilitating it. If you are a leader in those countries you have to listen to Chinese leaders. This has more impact than if it comes from a U.S. President, no matter the party.

More importantly for this audience, China also aspires to be a tech superpower, an explicit goal of their oft-cited “Made in China 2025” plan. The U.S. lets capitalism pick winners and losers, for the most part, and we end up with Microsoft, Facebook, Google, Amazon, and Oracle. In China, the government is building its own Internet and shepherding its own tech goliaths, which Mr. Bremer thinks will help fragment the global market into two camps. The Europeans or Japanese will not be able to sustain a third (or fourth) way and will align with the U.S. Other countries, particularly those with heavy Chinese investment, will align with China. This also matters because the U.S. (and the West) have yet to come up with an effective deterrence on cyber and IP theft, one way other countries can advance their own tech efforts.[1] Any bifurcation of the market will be bad for business, with companies trying to straddle the gap, having to invest to support two different ways of working. This also puts those investments in the crosshairs of their employees and other stakeholders, as we have seen in the press recently concerning Google and Microsoft. The picture that Mr. Bremer painted was grim but realistic and a good segue into discussion of Mr. Ellison’s talks.

Clearly Mr. Ellison relishes his current role of CTO because it gives him carte blanche to trumpet Oracle’s offerings and take aim at his global competitors. In the past, that list might have included SAP, their enterprise applications nemesis. But this year both Mr. Ellison and Mr. Hurd thanked SAP for their decision to re-platform their entire portfolio on HANA, their in-memory database offering. Both Oracle execs see this decision as a boon to Oracle as it gives every large enterprise an opportunity to rethink their SAP investments, and Oracle is happy to be there every step of the way to move the needle toward Oracle.[2] Instead, Mr. Ellison was laser focused on the cloud market leader, Amazon Web Services. This makes sense, since Oracle is all in on the cloud and wants not only the applications business with their customers but also to have that business run on their cloud, not Amazon’s (or anyone else’s for that matter). That cloud must be secure to meet the global challenges laid out by Mr. Bremer and Mr. Hurd and that takes the “Second Generation” of their cloud, which Mr. Ellison described at length in his keynote. He claimed they have been working on this Gen 2 cloud for some time, building in “Star Wars” defenses. His presentation subtitle was “Impenetrable Barriers + Autonomous Robots.” To make their cloud impenetrable they have added a new network of dedicated cloud control computers that separate cloud control from cloud workloads running to support customers. Mr. Ellison claimed that this new architecture keeps their cloud protected from the outside and keeps their customers running on that cloud protected from others (and Oracle). He stated that using this approach threats can’t enter and spread. Solving this problem required both new hardware and software. According to Mr. Ellison, some of that software was developed using machine learning, i.e., their autonomous robots. He claimed that their autonomous database was self-patching, self-repairing, with those robots finding and killing threats as they arise. It provisions itself, adds network capacity, scales itself if the load grows, and security is automatic. Gen 2 adds these robots and other automations that make it much cheaper to run than, say, Amazon. How much cheaper? Mr. Ellison claimed that companies could cut their Amazon bill in half—guaranteed.

Mr. Ellison went on to present a long series of ways that Oracle was more efficient and cheaper than Amazon’s offerings. Each chart compared the Oracle Cloud Infrastructure (OCI) with AWS. On measure after measure Mr. Ellison claimed a substantial lead. To sum up, Mr. Ellison also pulled out an applause line from 2017: “you get all this but you have to be willing to pay less.” Oracle is also working to make it easy to bring existing workloads into the cloud. If you are running SAP on an Oracle database Mr. Ellison claimed you can just bring it to the cloud including customizations. This is a “lift and shift” strategy now common in the PLM space, with Aras, Oracle, PTC, and Siemens PLM Software all offering “lift and shift” support for moving on-premise Innovator, Agile, Windchill, and Teamcenter, respectively, to the cloud. Mr. Ellison claimed that lifting and shifting to Gen 1 clouds would cost you more than to Gen 2, something that would be difficult to measure, but surely Oracle will gladly help you with all of these calculations.

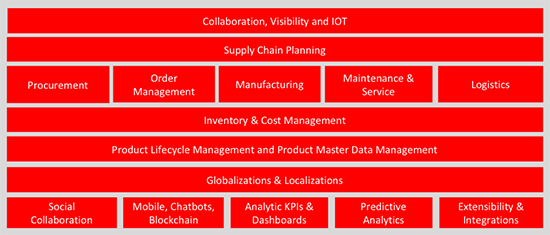

How is all of this going to help companies manage their product lifecycles? Mr. Rick Jewell, Oracle Senior Vice President for Supply Chain Management (SCM) Applications, highlighted the Oracle Digital Supply Chain Platform, Oracle’s positioning of much of their enterprise software portfolio, enhanced for/with a set of technologies including social, mobile, analytics, blockchain, and the IoT as shown in Figure 1.[3] Injecting today’s technologies into existing enterprise application categories is the same issue facing all of the leading enterprise software firms, like Oracle, SAP, and Infor. The world is moving fast and demands these new capabilities as part of their traditional three letter enterprise applications, like enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), and product lifecycle management (PLM). All believe, rightfully, that these new capabilities are best delivered integrated with enterprise offerings to augment their capabilities, delivering information, analytics, and guidance at the point of work, helping humans make better decisions. According to Mr. Jewell, Oracle added about 1,200 customers for Oracle Supply Chain Cloud last year, giving them well over 2,500 engaged with Oracle and their partners. Specifically, Mr. Jewell cited an Oracle PLM Cloud implementation at Broadcomm which includes Oracle Product Development Cloud, their cloud-based solution targeting their traditional Oracle Agile user base, good news for their cloud PLM efforts. He also spoke about Oracle’s support for the digital twin and digital thread, rhetoric familiar to the PLM economy. Oracle sees digital twins as essential in their IoT and lifecycle support strategies, as do others in the market, but Oracle has some challenges there when compared with the other market leaders. Many of their competitors more fully support engineering work in process and have more ready access to 3D intellectual property and development requirements, key parts of the digital thread used to construct downstream digital twins. Oracle can successfully combat this gap in their thread using consulting and packaged offerings, something that Oracle assured is part of their plan for meeting digital twin requirements.

When CIMdata works with industrial clients, one thing we suggest they consider is if their chosen provider uses their own solution as part of their business. Mr. Jewell provided an update on last year’s promise that Oracle would run their entire business on Oracle Cloud. Mr. Jewell was proud to report that Oracle shut down their internal Oracle E-Business Suite applications and now rely on Oracle Cloud to run their far-flung business. This is a good sign for Oracle’s customers as any pain Oracle’s internal users experience will more likely result in more timely updates.

Figure 1—The Oracle Digital Supply Chain Platform

As can be seen in Figure 1, PLM and Product Master Data Management play a central role in their platform. They can also bring some of the trendier capabilities like social, mobile, analytics, IoT, and blockchain to bear on PLM use cases. But getting from today’s PLM to tomorrow’s augmented intelligent system that can leverage all of these capabilities is still a work in process. The core Oracle PLM Cloud is coming along nicely, including their planned cloud-based replacement for Oracle PLM for Process, a key capability for firms with both discrete and process PLM requirements. It is the Industry Solutions Group (ISG) group that is responsible for synthesizing new solutions that best leverage these new capabilities for PLM use cases. Today this is mostly consulting but solutions most likely will follow. This makes sense and is consistent with the way other leading PLM solution providers, like Dassault Systèmes and Siemens PLM Software, are crafting industry-focused offerings. In addition to work by the IBU, key Oracle partners like Accenture and Deloitte are also using these building blocks to create new capabilities, a big factor in some of their large industry deployments.

Overall, the Oracle PLM strategy remains consistent, with customers allowed to mix and match Oracle’s on-premise and cloud offerings. The way forward in PLM is Oracle PLM Cloud, which is starting to get some traction in the market. Oracle PLM Cloud consists of five modules: Oracle Innovation Management Cloud, Oracle Project Portfolio Management Cloud, Oracle Quality Management Cloud, Oracle Product Development Cloud, and Oracle Product Data Hub. In recent presentations, PLM was described as spanning “Innovate, Develop, and Commercialize” in Oracle’s positioning. A major change was discussed by Mr. John Kelley, Oracle Vice President of Product Value Chain Strategy, in his Tuesday session. As a company Oracle has talked a lot about IoT, has native capability in enterprise asset management, and has made investments in SaaS field service management with their TOA Technologies acquisition in 2014. Now that downstream part of the lifecycle is explicit in Oracle’s PLM strategy, with an increased emphasis on the digital twin. This is an important move for Oracle. It is a good response to the positioning of the other leading PLM firms. But it is also important because their customers’ products are increasingly relied upon as part of product as a service strategies. More and more industrial customers care about the full lifecycle of their products and they cannot make money doing it without the right data about their products, from the enterprise product record, and the right data from their products, gathered by IoT and turned into actionable insights by analytics and machine learning. These are early days for this strategic shift but it is a welcome expansion.

CIMdata also learned more about an exciting new capability becoming available in the Oracle PLM Cloud offering, the Applications Composer, which will provide a new way to extend Oracle’s cloud solutions. This began a few years ago in the Oracle Customer Experience side of CRM and has moved into their supply chain applications. Oracle needs to enable the Applications Composer for each object, but users will be able to extend those existing objects by adding new fields, new attributes, and changing screen layouts. Users can also create new objects and start creating relationships in their data that did not exist before. This capability is available now in Innovation Management Cloud and Quality Management Cloud, with Product Development Cloud to come. One of the limitations of Oracle Agile was its extensibility so this is big news in the Oracle PLM customer ecosystem. CIMdata looks forward to learning more as Oracle PLM Cloud gains more customers using this capability.

In conclusion, OpenWorld is an expansive event that one analyst cannot cover. (That is why Gartner and IDC send dozens.) The company has made great strides in its cloud strategy but there is still much work to be done. Mr. Ellison's strategic gaze is certainly laser-focused on Amazon, based on his keynote, and he even had some kind words for SAP, thanking them for changing platforms and putting many long-time customers potentially in play for Oracle. Their Oracle Digital Supply Chain Platform is an excellent example of platformization, an emphasis for CIMdata over the last several years. Their enterprise product record, Oracle’s term for the digital thread, is at the core of their offerings, and they are bringing today’s technologies to bear for their customers, a journey that is just beginning but the early returns are promising. The cloud is essential to the future of product lifecycle management and Oracle has invested more than any of the current players in getting their PLM and vast enterprise offerings to the cloud. Now it is time for the market decide.