Key takeaways:

- Industry 4.0 and digital transformation are having global impacts and Accenture is riding this wave with their Industry X.0 practice.

- To Accenture, Industry X.0 is the digital reinvention of industry, where businesses use advanced digital technologies to transform their core operations.

- Their global Industry X.0 practice has over 13,000 practitioners, and can draw upon Accenture’s 500,000+ staff, knowledge, and technology resources.

- Accenture recently expanded their vision with “Reinventing the Product,” a new book that combines their vast consulting experience with leading edge industrial research to help companies navigate this smart connected future.

Research for this commentary was partially supported by Accenture.

Digital transformation and Industry 4.0 are global trends impacting a wide range of industries. CIMdata had the pleasure of speaking with Mr. Eric Schaeffer and Mr. David Sovie, both Senior Managing Directors at Accenture, the world’s largest consulting firm.[1] Both men wear two hats at Accenture. They each lead one of Accenture’s industry-focused consulting groups (Industrial for Mr. Schaeffer and High-Tech for Mr. Sovie) as well as leading their Industry X.0 practice, which includes their work in product lifecycle management (PLM). Based on CIMdata’s global PLM market research, Accenture has expanded their leadership in PLM-related consulting over the last several years due, in large part, to their role in delivering PLM as part of Industry X.0 engagements. In 2017, Mr. Schaeffer published a book on “Industry X.0” and just this year Mr. Schaeffer and Mr. Sovie co-authored a follow-up, “Reinventing the Product.” This new book looks at the on-going transition to smart, connected products and their associated ecosystems, and leverages their consulting work and joint research with other organizations, including the World Economic Forum (WEF).[2]

According to Accenture:

“INDUSTRY X.0 is the Digital Reinvention of Industry, where businesses use advanced digital technologies to transform their core operations, their worker and customer experiences, and ultimately their business models. New levels of efficiency are achieved in the core of R&D, engineering, production, manufacturing and business support through integrated systems, processes, sensors and new intelligence. Worker and customer experiences are reimagined and redesigned through personalization and advances such as immersive, augmented, and virtual reality. New business models and revenue streams are unlocked by smart, connected products, services and plants that are enabled by new ecosystems.”

CIMdata joined the Accenture team on the phone and the interview that follows was edited for clarity.

CIMdata: Industry 4.0 is an idea that has been around since 2006, formalized by the German government between 2011 and 2013. When and how did Accenture get started on its Industry X.0 vision?

Eric Schaeffer: Accenture has really been focusing on Industry X.0 since the early 2010s. We created an industry-focused X.0 practice in Dave’s area and had a practice in my area, Industrial, which includes all of the products in discrete like automotive, industrial equipment, and life sciences, and a few others. Then we brought these two practices together, realizing there was a lot of commonality and knowledge that could be shared between what was happening in high-tech, and also in aerospace and the automotive industry.

Then we accelerated our growth through acquisitions. We are now a practice with over 13,000 practitioners globally, serving multiple product-related industries. We’ve built this practice over time working with our ecosystem partners, such as SAP, Dassault Systèmes, Siemens Digital Industries Software, PTC, and Autodesk. We are also working closely with the World Economic Forum. Accenture has been part of multiple research efforts presented at Davos between 2016 and 2019. For example, we presented research on how the Industrial Internet of Things (IIoT) will transform industry. Another was on the digital transformation of industry—DTI—where we discussed the future of jobs and how artificial intelligence is changing roles in specific industries. We do similar work with academic institutions like MIT and universities across the world on different topics.

David Sovie: It depends a bit on the spirit of your question. Industry 4.0 has been around for a while. Now we have Industry X.0, how is it different? We absolutely got some original inspiration from the idea of Industry 3.0 going to Industry 4.0. The core of Industry 4.0 is around manufacturing. Our view, and why we chose to call it Industry X.0, is for several reasons. We expanded the definition beyond manufacturing. In a world of smart connected products, it changes everything. If you are a product company, it changes how products are conceived, designed, engineered, manufactured, how they are distributed, and how they are serviced and supported. …over the lifecycle, particularly now with such sensorized products, data coming off of products, companies are much more than a manufacturer. Our view is a broader, end-to-end view of a smart, connected, AI-enabled product over its lifecycle. It’s inclusive of the concept of Industry 4.0 with a center of gravity on manufacturing. Our view is definitely a broader perspective.

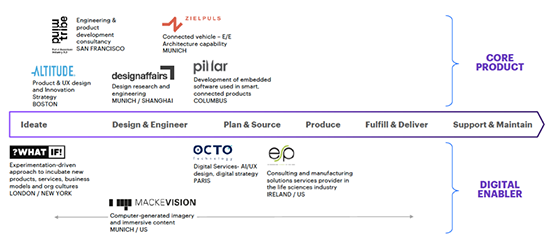

CIMdata: Accenture has acquired dozens of companies over the last several years, many of which could apply to Industry X.0. (See Figure 1 below.) How are you bringing those new competencies to bear?

Schaeffer: One of the principles of the book is to not destroy the value of the acquisition. Do not destroy what has made these individual companies unique, highly differentiated, and highly successful in the market. The first thing we do, I would not call it an integration, but it is how we interlock the new acquisition to core Accenture. We have to make sure we can tap into what is unique in that acquisition. The second principle is that we stabilize the relationship because though they are not yet fully integrated they can tap into Accenture resources, understanding the breadth of what Accenture brings to these acquisitions. It takes a bit of time for the newly acquired team to fully understand what they can leverage and how to access these resources which they now have in abundance, which was not the case before.

Figure 1—Accenture's Recent Acquisitions in Industry X.0

(Courtesy of Accenture)

Step three is the geographic distribution of some of these acquisitions. How do you bring these acquisitions together? Take, for example, what we are doing in Munich, Germany. We are bringing “together” Zielpuls which is all about electrical and electronic architecture for the vehicle, with designaffairs which is all about the design, with Mackevision, which is all about the digital twin. Bringing these capabilities together, we can bring a far more compelling value proposition to our clients in an end-to-end capability.

Sovie: At the highest level, Accenture, has made about 100 acquisitions in the last three years. We feel that we’ve developed this as a core competence. In particular, where we’ve made a lot of acquisitions was in the digital marketing space. Nearly half of the acquisitions were in the digital marketing space. We are now recognized [by AdAgency and others] as the #1 player in the digital marketing space. We look at Industry X.0, we see it as a similar structure. There are a lot of really interesting boutique companies with interesting skill sets, but pretty fragmented. We believe this is a new addressable market for us. There are companies that expand our addressable market by going after the value chain that we discussed earlier. Companies that focus where product design meets hardware engineering, there are companies focused on connected product software and software engineering, there are some that are more focused on manufacturing and digitizing manufacturing. But overall, we know there’s a lot of really good talent out there. We sent you the slide (the image is shown in Figure 1) that shows the 9 companies that are squarely in the Industry X.0 space. And there are other companies that we’ve acquired that contribute to supporting Industry X.0 that are not in the figure. Expect to see many more acquisitions from us as part of our strategy over time.

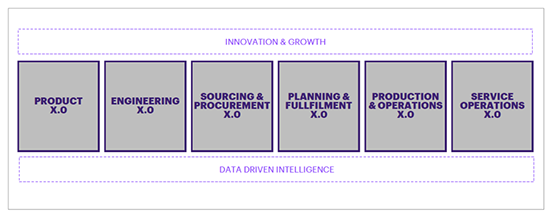

Figure 2 shows how we are supporting our customers across the product lifecycle with different elements of our Industry X.0 Framework.

Figure 2—Accenture's Industry X.0 Framework

(Courtesy of Accenture)

CIMdata: What technology partners are critical to your Industry X.0 practice? Other parts of your ecosystem?

Schaeffer: There are different ecosystems. There is an ecosystem around each functional domain. We have one around PLM which we mentioned. Many of these partners are spread across multiple domains, such as Dassault Systèmes, Siemens, PTC, and SAP.

We have within our Accenture Innovation Architecture, Accenture Ventures, which aims at screening innovation, the startup world, and qualifying different startups so that we and our clients can tap into these startups as required. Then Accenture Ventures also may make minority investments in a very limited number of startups to help them better define their product and service roadmap. That is our ecosystem around startups.

One ecosystem worth mentioning is with our clients because more and more we have innovation partnerships or multi-year agreements with our clients to help them identify the new value spaces—smart and connected value spaces—and then help them redefine their smart, connected product and service roadmap. How do we help our clients go to market? Sometimes we are embedding some of our client’s solutions in the solutions we go to market with.

Sovie: One of our core keys to success is our ecosystem. We have some 200 ecosystem partners that we have formal relationships with and alliances in place. We’re the #1 partner for the majority of the leading traditional software companies, Eric mentioned some of them in traditional PLM players and MES players. We also have both traditional and emerging partners, and cloud supply chain partners.

If you think about this world of smart, connected products, the cloud players come into play more. Companies like Amazon Web Services (AWS), Google Cloud Platform, Microsoft Azure, and in China, Alibaba. We see the combination of software companies: PLM, MES, supply chain, plus the cloud players. Schneider Electric was a quite public example where we signed a multi-year innovation agreement. Faurecia is another public example, an automotive supplier that we signed a collaboration agreement with and those are players that, five years ago, wouldn’t have been our ecosystem partners. The last one I’ll mention is the semiconductor players. At the core, creating new types of IoT devices relies on chip sets. We’ve been increasingly working much more closely with semiconductors who are thinking about products that are five years out.

Schaeffer: Just to add on the ecosystem, as you mentioned the semiconductors, I want to bring up the device makers. We also have these partners in our ecosystem, and we’re building it progressively with preferred partnerships with engineering companies, mainly mechanical engineering companies, as well as looking around contract manufacturing. Because if you look at the acquisitions we’ve made over the past 4 or 5 years, you’ll see that they are very much around product innovation and design; they are very much around software. They are limited in terms of hardware engineering capabilities. We’ve acquired a very small company in that space because you need to understand how to design and engineer hardware, “the box,” to be able to help and advise your clients on the experience and on the software and all of the digital technologies which you need inside “the box.”

But we’re not in the engineering outsourcing business where we design and engineer the whole system: hardware, software, digital, and the whole. We are here to help our clients accelerate their own capabilities, augment their capabilities, or help them accelerate their product development process by bringing point skills. In many of my industrial clients, they are very good at hardware, less good at software, and getting their hands on artificial intelligence, analytics, so more of the core digital technologies. And this is where we can help our clients accelerate building their own capabilities in bringing their smart, connected products to market. By providing these software and digital capabilities which they do not always have.

CIMdata: What do you think is making you successful?

Schaeffer: There is one that Dave touched on that I’d like to reemphasize that ties back to the book that Dave and I co-authored, “Reinventing the Product.”

The way we look at Industry X.0 is to focus on how our clients can leverage digital technologies to drive efficiencies in their operations. That is consistent with Industry 4.0. We also help our clients leverage digital technologies to drive innovation and growth, more focusing on the top-line agenda of our clients. How is digital really transforming the products and services of our clients? We’re seeing the value of a product shifting from hardware to electronics, that was a couple of decades ago, to embedded software, to digital technologies. Digital is where the interest and the value now comes from.

The way we position our X.0 practice with clients, or in the market, is really around helping our clients reimagine their products and services, reimagine their supply chain, reimagine their business, and capture trapped value. Here are data points which are interesting for me from a piece of research we released at Hannover Messe in April this year. We surveyed 1,500 companies, industrial manufacturers across the world and close to 70% of the companies we surveyed said that 20-30% of their revenues within the next 3-5 years would be AI-enabled—they would come from smart, connected products and services. 20-30%, that’s not anecdotal in terms of revenue, and that won’t happen by chance.

The second data point…the challenge many of the executives’ face is not the number of Proofs of Concept (PoCs) that they have in their company. There are PoCs all over the place. It’s how do you scale these PoCs? How do you cash in the highest return?

In the same sample of 1,500 companies, only 20% of the companies we surveyed were able to scale more than 50% of their PoCs but, more importantly, these cashed in more than the expected returns. On average they had a 27% ROI for 21% of the companies we surveyed, which is quite high versus the rest of the sample which was between 6 and 8%.

You’ll find some of the insights we captured from these companies from the work that both Dave and myself have been doing. What does it take to be able to scale your PoCs and cash in the 20+% return on investment?

We call these the “Markers for Success.” There are a few lessons learned here I think we can leverage. This is the core of our Industry X.0 practice, helping our clients capture these new value spaces, reinventing their products and their services, but also helping our clients really accelerate the digitalization of their enterprise.

Sovie: To make it explicit, we do see value in the integrated set of capabilities to allow us to create an integrated transformation for our clients. Our clients can be siloed across engineering versus manufacturing versus supply chain. In general, historically, a lot of the vendors in the marketplace were also pretty siloed. If you believe in this concept of a digital thread that cuts across the whole product lifecycle, which we do, then that can drive an operational transformation where the combination of all these skills is greater than the sum of the parts. We do believe in that and we are seeing clients really only recently starting to realize some value from an enterprise level digital transformation cutting across all of these functions. That integration is a key differentiator for us.

The second part, it’s not just about the internal operations, its actually changing the business model and the experience the product delivers. What do I mean by that? We also talk about that quite a bit in the book. Smart, connected products, it’s much more about the experience than the hardware features. Some of the acquisitions we’ve made in digital marketing, companies like Fjord are fantastic at the experience design. We see us combining experience design with Industry X.0 to help our clients fundamentally rethink what a connected product experience is. Historically products were sold in many cases in a quite transactional way…you made a product, you sold it through a distributor or retailer or a dealer and maybe had a warranty contract. Other than that, you really did not have much of an on-going relationship with the customer experience. It’s really different in a connected world. For some of them it’s even changing their business model completely, selling it as a service, or into a platform-based business model. For us, when we combine that track with business model innovation or experience innovation, those are pretty big differentiators for us in the marketplace.

CIMdata: Where does Industry X.0 go from here?

Schaeffer: I’ll start from an industrial perspective. There are a couple areas where we are investing. One is around what we call “Mobility X.0.” This is all around autonomous and connected vehicles to start with and then we’ll move into the broader mobility sector. It’s really helping both the OEMs and the Tier 1 and 2 suppliers address “CASE”: connected, autonomous, shared, and electrical. So that is clearly one area. You could have seen through a few of the acquisitions we made that this is an area where we are building up capabilities organically and inorganically in the key markets.

Sovie: There are two ways to view the question. What are we doing at Accenture? And where do we see the market going? At Accenture you’ll see us continuing to do acquisitions. We think we’re still in early days of creating this end-to-end value proposition and the ability to do it on a global basis. Just like we did in digital marketing, you’ll continue to see us do more in this area.

We are seeing these concepts as having real extension outside of just product companies. Take, for example, the concept of a digital twin and thread. We started talking to some of our big cloud providers about a digital twin for a data center because building a data center is billions of dollars. Or creating the concept of a digital twin and thread for an offshore oil rig, or a utility infrastructure plant. We are seeing the concepts of Industry X.0 apply to a wider range of industries, not just people that make products, manufacture products. It also applies to anyone that has significant infrastructure as part of their business model. So, I do see us expanding this concept into industries that you might not, at first blush, thought this was relevant to.

CIMdata: Thanks for your time gentlemen, it was a very interesting, thought provoking discussion and look into the ever-evolving state of Industry X.0 at Accenture.