Key takeaways:

- PLM, which embodies the virtual assets of companies combined through mergers or acquisitions, is crucial for predicting and realizing potential synergies.

- PLM solution integration experts must be engaged early in the merger or acquisition target selection and due diligence so they can take appropriate action to realize synergies.

- Choice of the right framework for PLM harmonization is crucial for mitigating risks and gaining the benefits of a merger or acquisition.

- Wipro is a global leader in providing both strategic advisory and integration implementation support to get the most from merger and acquisition activities.

The growth of cloud computing, Internet of Things (IoT), and advanced analytics will enable new product systems, business models, and value chains, driving up the frequency of mergers and acquisitions globally, wherever and whenever new capabilities need to be added to businesses where organic development would be too slow and uneconomic.

Role of PLM in Mergers and Acquisitions

The success of a merger or acquisition depends primarily on the realization of anticipated synergies in the short-term, and in the long-term, the integration of the enterprise solutions of the merger or acquisition partners to achieve the post-merger transformation. In mergers and acquisitions (M&As) of most manufacturing related businesses, the synergies are usually predicated based on existing Enterprise Resource Planning (ERP) solutions, which support the organization’s physical assets, without adequate attention to existing Product Lifecycle Management (PLM) solutions, which define and control the intellectual assets (i.e., the organization’s virtual product and process definitions) that form a company’s foundation for product development.

CIMdata believes that to accurately predict and realize the value expected from M&As of product development and manufacturing companies, as well as to efficiently execute the post-merger integration of intellectual assets, PLM harmonization and implementation teams must be engaged at appropriate times along the M&A timeline.

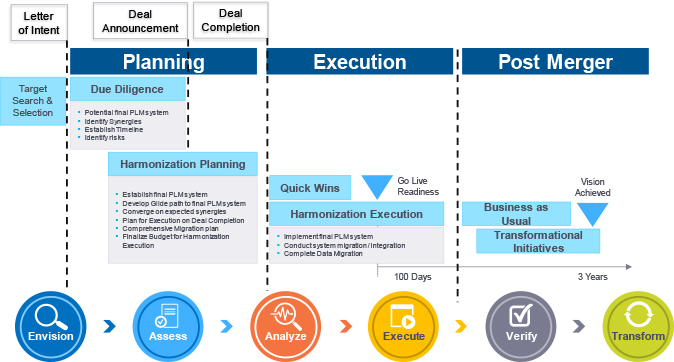

- The M&A timeline begins with the search for and the selection of a merger or acquisition target. Following that, the letter of intent (LOI) and the due diligence process begins, during which the potential final PLM system should be considered to identify synergies. These can be used to establish the PLM harmonization timeline and identify PLM related risks. This due diligence process continues until deal announcement.

- PLM harmonization planning should begin before deal announcement and continue until deal completion. During PLM harmonization planning, the final PLM system should be established and a glide path to it should be developed. A plan for executing PLM harmonization, after deal completion should be established once the expected benefits have been converged upon. Finally, under harmonization planning, a comprehensive migration plan should be developed and the budget for executing the harmonization should be drawn up.

- The PLM harmonization execution could stretch from deal completion to 100 or more days. During this time, the harmonized PLM system should be made ready to go live, establishing a quick win, to ensure low resistance to adoption. The PLM harmonization execution should be targeted for completion around 100 days after deal completion, to show progress within a fiscal quarter.

- Beyond PLM harmonization execution, the business-as-usual of the combined companies is ensured first, followed by the post-merger activities of transforming the combined businesses, with the support of the PLM experts.

Essentially, the PLM harmonization team members must work closely with the due diligence team members, prior to deal announcement, for a coordinated identification of the synergy-assumptions, the value drivers, and the potential risks.

The similarities or dissimilarities between the PLM solutions of the merging businesses and the strategic post-merger initiatives drive the choice of the framework for the harmonized PLM solution of the combined company. At one end of the spectrum, we may consider a data hub between the two PLM solutions that essentially allows a coexistence of the two PLM solutions without any significant change. At the other end of the spectrum, we may consider a service oriented architecture (SOA) to target a flexible PLM solution to support potential future adjustments to the combined business. The PLM data hub[1] may integrate information across lifecycles and manage relationships to provide a single source of shared enterprise data regardless of origin, enable Master Data Management (MDM) for provenance and primacy of data, enable traceability of data sources throughout the enterprise, and manage access to shared data and IP. While a SOA based integration[2] may be comprised of Object Management Group (OMG) PLM services, an enterprise service bus, and Business Process Execution Language (BPEL) for process modeling.

Wipro’s Strength in PLM Advisory and Implementation for M&A

Wipro’s expertise in PLM consulting and implementation in the arena of mergers and acquisitions has been developed over a decade, working on a large variety of integrations across several industrial verticals.

As shown in Figure 1, Wipro has developed a proprietary M&A playbook for PLM integration with different phases that can be mapped against the standard timeline of mergers or acquisitions. Wipro’s M&A playbook consists of six phases, which are, Envision, Assess, Analyze, Execute, Verify, and Transform. Wipro states that it has deployed this playbook successfully at a number of customers, helping them achieve PLM synergies.

The Envision and the Assess phases correspond to target selection, due diligence, and PLM harmonization on the M&A timeline where Wipro’s advisory strengths are called upon. The Analyze and the Execute phases are crucial for realizing the expected benefits of the merger or the acquisition, while the Verify and the Transform phases support the post-merger integration. The Analyze and the Execute phases which are the backbone of Wipro’s M&A playbook are highlighted here.

Figure 1—Wipro’s Playbook for PLM Integration During M&A

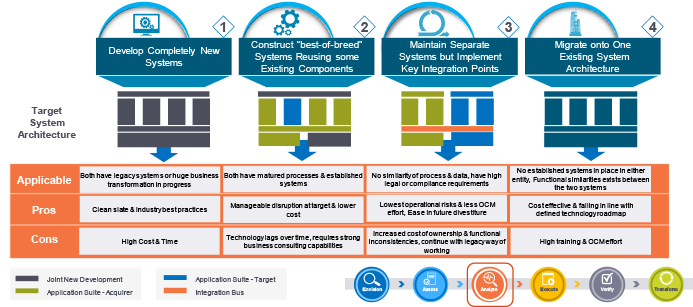

The Analyze phase of Wipro’s playbook is based on four PLM systems integration schemes that cover a broad spectrum of M&A scenarios. These schemes are shown in Figure 2.

Figure 2—PLM System Integration Schemes

- The first scheme considers two businesses that both have legacy systems or are undergoing significant business transformations. In this scenario, Wipro envisages a completely new PLM system for the combined businesses, which may be costly and time consuming but presents an opportunity to target industry best practices.

- The second scheme considers companies that may both have mature processes and optimum PLM systems individually. In this scenario, Wipro recommends coming up with a “best-of-breed” system for the combined business by picking and choosing elements that will optimize the overall system. It will potentially lead to manageable disruption and lower cost of integration.

- In the third scheme where Wipro considers two PLM systems which are mature and quite different due to differences in processes and compliance requirements, an integration bus connecting the two dissimilar systems without attempting significant changes in either of the systems, is recommended. This option enables the lowest operational risk and the least Organization Change Management (OCM) effort, while preserving the ease of future divestiture possibilities.

- Finally, Wipro considers the scenario where the processes prevalent in the two merger or acquisition businesses are similar but the acquirer has a mature PLM solution. In such a scenario, Wipro recommends moving the target’s PLM data and processes into the acquirer’s PLM solution. It is a cost-effective option which aligns well with the acquirer’s technology roadmap.

The Execute phase of Wipro’s M&A playbook provides ready-to-use accelerators to support various activities which might be needed during PLM system integration such as common data model development, data migration, training, roll-out, and hypercare (supporting the new system throughout its startup). Wipro undertakes this support through task-specific applications which have been developed and tested over a large number of mergers and acquisitions in different industrial verticals.

Wipro recognizes the need for a strong governance mechanism to ensure that the predicted PLM related synergies are realized reliably. Wipro has developed a robust governance model that mandates establishment of a program management office overseen by a steering group. The program management office (PMO) is responsible for target setting, knowledge management, performance management, benefits, resource management and corrective actions. To accomplish these tasks, the program management office forms an operations team comprising of customer (IT and business experts), system integrator (e.g. Wipro), and other IT/infrastructure services team members. The PMO also focuses on organizational change management (OCM) best practices to ensure successful adoption.

Wipro employs its PLM maturity model that classifies PLM maturity into five levels beginning with vaulting at a base level, moving from PDM to PLM at an intermediate level, and eventually, leading to digital PLM at the top. From its experience of executing PLM integrations related to M&A, Wipro has identified a collection of best practices across areas of Transformation, Technology, Governance, and OCM, which could help to proactively mitigate M&A risks.

Summary

CIMdata has observed that mergers and acquisitions tend to fail more often than succeed due mainly to a lack of application of disciplined processes in predicting and realizing synergies. CIMdata has also observed that those companies that have either merged with or acquired businesses in the past, have a better chance going forward of realizing the expected benefits and achieving the desired long-term businesses transformation than businesses attempting M&A for the first time.

CIMdata has found that although PLM is the intellectual engine that drives innovation and IP sharing, it does not play a big enough role during the due diligence process while predicting the benefits, as well as, identifying the risks to the realization of synergies due to ineffective PLM harmonization planning and execution. CIMdata recommends that PLM strategy and implementation teams be engaged early in the due diligence stages and remain engaged at least for 100 days past go live. Depending upon the complexity of the PLM harmonization between the merger or the acquisition partners, the PLM post-merger expert team should remain engaged to ensure desired transformations of the business.

CIMdata has looked at Wipro’s M&A related PLM advisory and implementation capability. Consequently, we feel that Wipro has developed a systematic playbook, a broad set of system of integration frameworks, a robust governance model, and a PLM maturity model to guide companies in realistically predicting and realizing PLM related value in M&As. CIMdata has also studied post-merger PLM integrations and concludes that Wipro should be considered as a PLM harmonization partner for realizing the long-term business transformation which may be expected from a merger or an acquisition.

[2] See: Srinivasan, V. “An Integrated Framework for Product Lifecycle Management”. Computer Aided Design, 43. 2011. pp. 464-478.